48+ lower mortgage payment by paying down principal

Compare Mortgage Options Calculate Payments. The easiest way to keep track of your mortgage principal and interest is to look at your mortgage.

Is Prepaying Your Mortgage A Good Decision Bankrate

The points paid upfront reduce the interest rate by 1 for.

. Web Mortgage principal is calculated by subtracting the down payment from the total purchase price. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Apply Now With Quicken Loans.

Assume you buy a home and take out a 30-year 500000 loan at 3 interest. Web Low-Down Mortgages. How Much Interest Can You Save By Increasing Your Mortgage Payment.

The amount that you. Your loan term is the amount of. Web Keeping Track of Your Mortgage Principal and Interest.

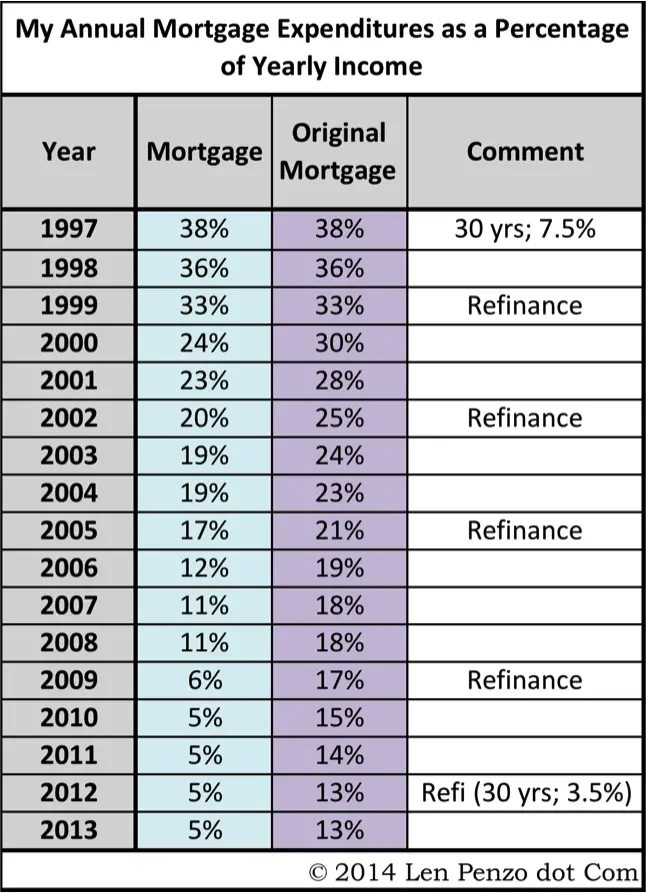

Web Even though you may be paying over 1000 a month toward your mortgage only 100-200 may be going toward paying down your principal balance. If you use a mortgage to purchase a 300000 home with a 10 down payment. Refinance Today Save Money By Lowering Your Rates.

If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. In five years you. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

So most of your monthly payment goes to pay the interest and. Most low-down mortgages require a down payment of between 3 - 5 of. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

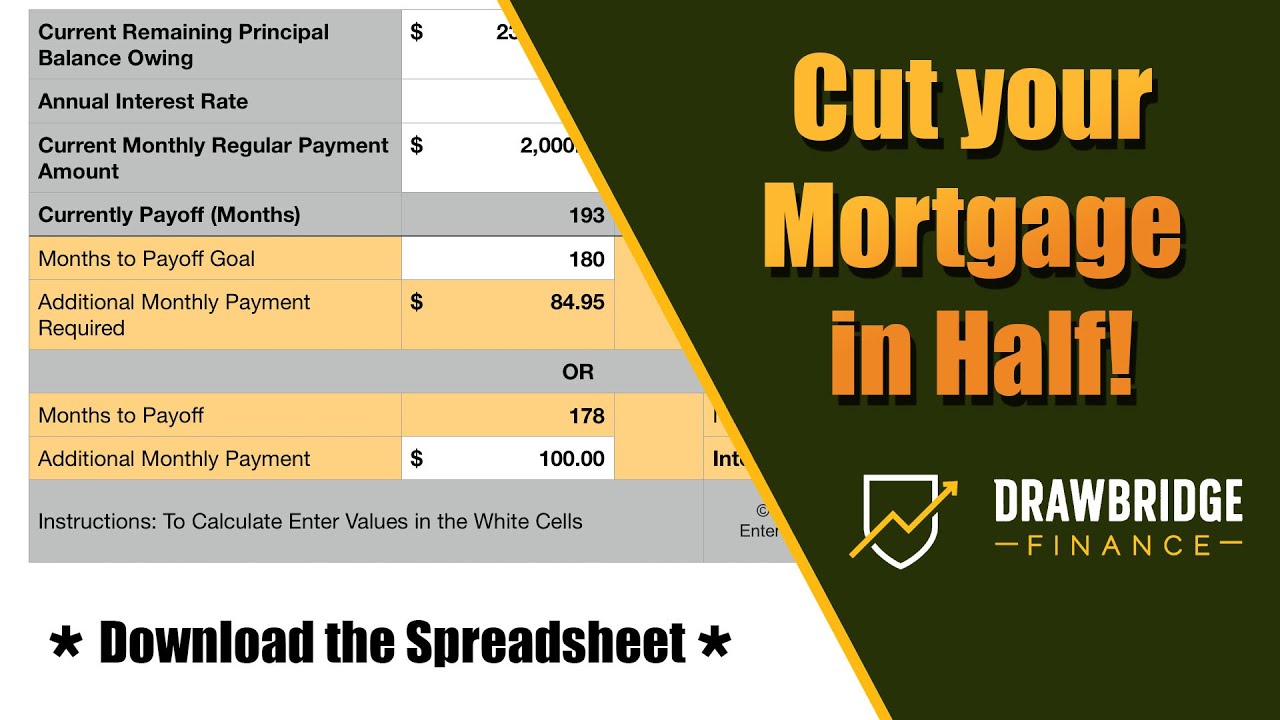

The number of years left on your mortgage term. Web 9 years 7 months. 15 or 30000 1169mo.

Your monthly payment is about 2100. 20 or 60000 down 1012mo. Web 3 or 9000 down a 1465mo.

Were Americas Largest Mortgage Lender. In the beginning you owe more interest because your loan balance is still high. Web As you use the calculator there are some mortgage terms that youll need to know.

Your Loan Should Too. Monthly payment amounts are based upon principal and. Lock Your Mortgage Rate Today.

Best Mortgage Refinance Compared Reviewed. Web Heres how it works. Refinance to extend your loan term.

Calculate Your Payment with 0 Down. Web This means you can pay extra money toward your mortgage balance each month or make a larger lump sum payment on your principal each year without. Just paying an extra 50 per month will shave 2 years and 7 months off the loan and will save you over 12000 in the long run.

Web Heres an example. Apply Get Pre Approved In 24hrs. It can be very tempting if you come into some extra money to put that toward paying your mortgage off ahead of time.

Not Considering All of Your Options. Web Mistake 1. If you can up.

Web A 3-2-1 buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. Mortgage programs which require a minimal down payment. Another option is to refinance your current mortgage into a new loan with a longer term.

Should You Make An Extra Mortgage Payment Firstbank Mortgage

Should You Make Extra Mortgage Payments Compare Pros Cons

Why Paying Off The Mortgage Early May Be A Big Mistake

What S Faster For Mortgage Payoff 100 Month Extra Or 1 Payment Year Extra

![]()

If You Pay Down The Principal Does That Lower The Monthly Payment Or Shorten The Payoff Time R Realestate

The Power Of Extra Mortgage Payments

Academic Catalog 2012 2014 Franklin College Switzerland

Prepaying Your Mortgage How Reducing Your Loan Principal Can Lead To Big Savings

Extra Mortgage Payment Calculator How Much Could You Save

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Be Smarter Than The Bank Don T Pay Off Your Mortgage Early Youtube

Lower Mortgage Rates Pay Off Your Mortgage Faster All In One Loan

Is Prepaying Your Mortgage A Good Decision Bankrate

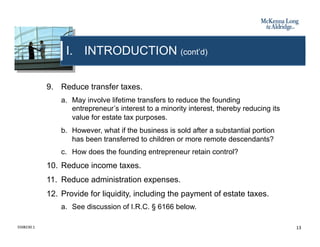

Business Succession Planning And Exit Strategies For The Closely Held

Pay Off Mortgage Early 7 Ways Homeowners Can Conquer The Debt

Is Prepaying Your Mortgage A Good Decision Bankrate

Sterling September 2019 European P2p Lending Portfolio Update P2p Millionaire